To outperform their rivals, private equity firms will need to enhance their ability to spur organic growth in the companies they own. (And public companies will need to follow.)

strategy+business magazineby Ken Favaro and J. Neely

Illustration by Kate Edwards

Image via WikipediaWhere does private equity go from here?

Image via WikipediaWhere does private equity go from here?

What’s more, private equity firms are going through this process of reinvention at a time when they’re facing plenty of other issues: bad press about fees, bad press about the practice of secondary buyouts (in which one PE firm sells a portfolio company to another PE firm rather than to investors via an initial public offering or to a corporation), turnover among limited partners, and the question of succession planning at the biggest firms (where at least some of the founders are getting on in years, and their peers are wondering how long they will stay in the game).

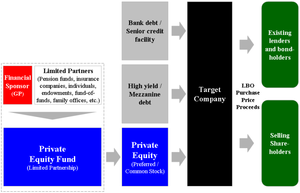

Image via WikipediaAll these things are distractions, however. The real issue for private equity is whether — and how — the general partners who manage PE firms can revitalize the leveraged buyout.

Image via WikipediaAll these things are distractions, however. The real issue for private equity is whether — and how — the general partners who manage PE firms can revitalize the leveraged buyout.

Having been forced to write down the value of many of their portfolio companies in recent years, the general partners of private equity firms have taken steps to implement cost savings across those companies. …

These improvements, however, aren’t sufficient to salvage investments that may be deeply underwater. ... A third wave of innovation in private equity’s value creation model is needed, and we believe it will be “organic growth enhancement,” or the ability to systematically increase the top line of portfolio companies organically. This will require adding new capabilities at the PE firms themselves, rebalancing their engagement with portfolio companies toward organic growth, and making organic growth “net free” (meaning that it’s funded out of each portfolio company’s own current costs and investment, with no hit to the firm’s short-term earnings). (See Exhibit 3.)

Some experienced PE players have already reached similar conclusions about the need for organic growth. The kind of cost cutting that firms initiated in the aftermath of the 2008 crash, says Henry Silverman, chief operating officer of Apollo Management, “is great, but it’s not really an outcome-driver. …you have to generate revenue growth — top-line growth — somehow.”

The math of organic growth may not be as instantly gratifying as the math of financial engineering, … It may not be as straightforward as removing head count and expenses to drive up EBITDA, with the automatic value increase that produces. The playbook for organic growth includes many more pages and is much more complicated. …

… As the PE firms learn to enhance the organic growth of their portfolio businesses, managers at public companies… may need to rethink their own ability to spur the organic growth of their businesses. …

The Third Innovation

…Since private equity’s emergence as a high-profile asset class in the 1980s, the industry has profited from two major innovations. The first was financial engineering …By the 1990s, however, … private equity firms seized on a second big innovation: Take out cost. …

Although not all private equity firms may yet recognize the focus on organic growth as their industry’s third major innovation, some have already been moving in this direction. “A lot of the guys I know [in PE firms] have been thinking about the growth and the strategy” of their portfolio companies, says Steven Neil Kaplan, the Neubauer Family Professor of Entrepreneurship and Finance at the University of Chicago’s Booth School of Business, singling out TPG, KKR, and Bain Capital. “They are all trying to [address] it in different ways.”

TPG is a good example of a private equity firm that’s leading the way. Like many other firms, TPG looks to its portfolio companies’ top executives, whether those it has inherited or those it has installed, to drive organic growth. However, its 60-person operations team includes experts in the areas of pricing and sales-force effectiveness, two disciplines that can have a big impact on revenues. In addition, the many TPG operations personnel whose backgrounds are in “lean” — an approach to reducing costs that focuses on process improvements, using customer benefits as the compass — occasionally help TPG’s portfolio companies grow, albeit indirectly….

Indeed, one big caveat attached to the idea that private equity firms need to find ways to spur organic growth is that spotting a growth opportunity usually requires an innate grasp of how a specific group of customers in a particular industry behave, and what those customers want. “You don’t understand how to create value unless you deeply understand an industry,” the University of Chicago’s Kaplan says. Most private equity firms do organize themselves by so-called industry verticals (health, consumer, retail, and technology are some common ones), but the expertise in those verticals is primarily for purposes of sourcing and making deals. …

…[Private] equity firms … will need to do three things: add new growth capabilities, rebalance the engagement with their portfolio companies in favor of growth, and find ways to make growth net free.

Adding Growth Capabilities

Of course, it’s always best, and simplest, if one has capable, growth-oriented executives running a portfolio company and the divisions within it…Where the right people aren’t already running, say, product development or marketing, private equity may need to provide external support for those functions.An infusion of organic growth capabilities can take several forms, and which one is best probably depends on the specifics of the private equity firm… One is better pricing ability. Another is improved sales-force practices, since the direct sales forces of acquired companies often have faulty structures or incentives, or aren’t disciplined about getting rid of underperformers….

Yet even with growth capabilities like these, many private equity firms don’t build them internally. …

Rebalancing the Engagement

PE firms need to make organic growth the primary focus of their engagement with their portfolio companies, so that it’s not crowded out by attention to costs. One way to do this is to introduce the concept of headroom as a framework for thinking about the growth available in a market. Headroom is a simple concept: It is the market share that a company doesn’t have minus the market share it won’t get. This framework has the advantage of breaking down the growth challenge into two binary questions. First, there is the question about who the potential switchers are — the customers in the market that aren’t 100 percent loyal to a rival. Second, there is the question of what it would take to get these less-than-loyal customers to switch. These are the needs-offer gaps.Headroom is particularly valuable as a tool for identifying organic growth opportunities in mature, highly competitive markets, …

For many companies, the other valuable outcome of a headroom approach is that it exposes areas of activity that can’t produce growth (for example, activities aimed at customers who are too loyal to other providers). …

Of course, headroom initiatives are only one example of how private equity firms can work with their portfolio companies to get them to think more explicitly about organic growth. …

Making Growth Net Free

…[The] funding for portfolio companies’ growth initiatives be net free, meaning the cash to invest must come from savings realized elsewhere within the portfolio company or from an “organic growth investment charge” that’s taken when the buyout is made. (See “A Different Way of Funding Organic Growth.”)…Reinforcing PE’s Baseline Capabilities

…Indeed, part of the promise of organic growth enhancement, as a PE innovation, is the impact it will have on the two capabilities that most general partners would say are as important as adding value to their portfolio investments — fund raising and deal making….In the future, having demonstrable organic growth capabilities will be part of what general partners sell, and something that reinforces their fund-raising ability…

The bottom line is that without a strategy for expanding organic, top-line growth at their portfolio companies, private equity firms will become less competitive at raising investor funds and making deals. …

By embracing private equity’s third innovation of enhancing organic growth — adding new growth capabilities, changing the dialogue with portfolio companies, and making organic growth net free — the most innovative PE firms will enrich their “solutions business,” and gain market share and improve their overall profitability in the process. As they succeed, they will ensure that their core business continues to be a vital force in the capital markets, and at the same time will help promote a more productive, growth-oriented perspective throughout the corporate sector.

Might the Contract Change?

In a world where private equity returns will depend to a greater extent on portfolio companies’ ability to grow organically, there may be an argument for lengthening the life of certain funds. The typical seven- to 10-year cycle of fund raising, acquisition, and exit may not make sense with investments that are generating good returns. After all, … it may be that after five years in the portfolio, the portfolio company is at the very beginning of what may be a decades-long rise in revenue and profits….“We’ve seen a couple of big investors that have been going through a broader bid process saying, ‘Is there a way to build a different partnership?’” adds the executive. But those inquiries, he says, have been less about changing the terms of private equity deals than about investing in other asset classes now under some equity firms’ roofs, like mezzanine funding and debt financing.

— K.F., J.N.

A Different Way of Funding Organic Growth

Investments in organic growth are often in R&D, sales-force expansion or restructuring, marketing, and advertising. These investments are often called revex (revenue expenditures) because they hit the income statement, whereas capex (capital expenditures) hit only the balance sheet.In the chase for bottom-line growth, revex creates a dilemma for most companies: The more they invest in revex to grow the top line, the more their bottom line suffers in the short term (other things being equal). Conversely, the more they skimp on revex, the more their top-line growth will eventually suffer.

No company is ever perfectly efficient, so there are almost always ways to take out costs and reduce other investments in order to fund more productive revex. Often, however, these opportunities are difficult to see, and companies are thus faced with real tension.

Many leaders of public companies, such as Robert Walter when he was CEO of Cardinal Health, have addressed this tension by setting up a corporate investment account that their company’s business units could tap into to fund organic growth investments. In Walter’s case, this was a way of not letting the accounting for organic growth get in the way of the need to invest in growth.

PE firms face the same tension, even though they are privately held, which makes us think they may have to do something similar in the future. Perhaps an “organic growth investment charge” could be taken when the investment is made, creating a cash account that could be drawn upon over time for investing in organic growth with less short-term accounting impact on the bottom line.

— K.F., J.N.

Reprint No. 11208

Author Profiles:

- Ken Favaro is a senior partner with Booz & Company based in New York. He leads the firm’s work in enterprise strategy and finance.

- J. Neely is a Booz & Company partner based in Cleveland. He specializes in mergers and restructurings in the consumer products, retail, and industrial sectors.

- Also contributing to this article was s+b contributing writer Rob Hertzberg.