Most executives take managing risk quite seriously, the better to avoid the kinds of crises that can destroy value, ruin reputations, and even bring a company down. Especially in the wake of the global financial crisis, many have strived to put in place more thorough risk-related processes and oversight structures in order to detect and correct fraud, safety breaches, operational errors, and overleveraging long before they become full-blown disasters.

Yet processes and oversight structures, albeit essential, are only part of the story. Some organizations have found that crises can continue to emerge when they neglect to manage the frontline attitudes and behaviors that are their first line of defense against risk. This so-called risk culture is the milieu within which the human decisions that govern the day-to-day activities of every organization are made; even decisions that are small and seemingly innocuous can be critical. Having a strong risk culture does not necessarily mean taking less risk. Companies with the most effective risk cultures might, in fact, take a lot of risk, acquiring new businesses, entering new markets, and investing in organic growth. Those with an ineffective risk culture might be taking too little.

Of course, it is unlikely that any program will completely safeguard a company against unforeseen events or bad actors. But we believe it is possible to create a culture that makes it harder for an outlier, be it an event or an offender, to put the company at risk. In our risk-culture-profiling work with 30 global companies, supported by 20 detailed case studies, we have found that the most effective managers of risk exhibit certain traits—which enable them to respond quickly, whether by avoiding

risks or taking advantage of them. We have also observed companies that take concrete steps to begin building an effective risk culture—often starting with data they already have.

Traits of strong risk cultures

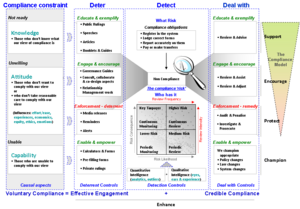

|

| English: Risk bow-tie for regulatory compliance strategies - deter, detect & deal with (Photo credit: Wikipedia) |

The most effective

risk managers we have observed act quickly to move risk issues up the chain of command as they emerge, breaking through rigid governance mechanisms to get the right experts involved whether or not, for example, they sit on a formal risk-management committee. They can respond to risk adroitly because they have fostered a culture that acknowledges risks for what they are, for better or for worse; they have encouraged transparency, making early signs of unexpected events more visible; and they have reinforced respect for internal controls, both in designing them and in adhering to them.

Acknowledging risk

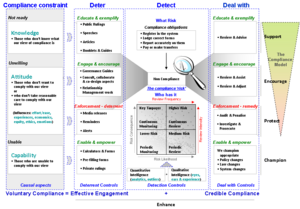

|

| English: A flowchart pointing out the different types of risks in Banking (Photo credit: Wikipedia) |

It takes a certain confidence among managers to acknowledge risks. Doing so—especially to the point of discussing them internally, as well as with shareholders or even regulators— requires that managers rely on their own policies and procedures to work through issues that could lead to crisis, embarrassment, or loss.

The cultural differences between companies that acknowledge risk and those that do not are quite stark. Consider, for example, two global financial institutions that take similar risks and share a similar appetite for risk. The first has built a culture, at all levels of the organization, that prizes staying ahead of the trend. ... The stance it takes is, “If we see it, identify it, and size it, then even if it’s horrible, we’ll be able to manage it.” Where risks cannot be sized, they are at least discussed in qualitative terms. ...

The second institution, in contrast, has a reactive and back-footed culture—one focused more on staying out of trouble, ensuring

regulatory compliance, and making sure all the boxes are ticked. Its managers are generally content to move with the pack on risk issues, preferring to wait for regulatory criticism or reprimand before upgrading subpar practices. ... This organization’s stance is, “Let’s wait until we really need to deal with these unpleasant things, because they’re anomalies that may turn out to be nothing at all.” ...

Encouraging transparency

|

| English: The diagram above represents a generic framework for risk management. (Photo credit: Wikipedia) |

Managers who are confident that their organizational policies and controls can handle—and even benefit from—openness about risk are more likely to share the kinds of information that signal risk events and allow the institution to resolve emerging issues long before they become crises. This means they spot a risk issue developing and mobilize the organization to analyze and remedy it—at the board level if needed, and often within a few working days. In one situation, a division of an energy-services company was operating a contract in an emerging country in which it had not previously worked. There, the division discovered employment practices among subcontractors that ran counter to its own policies and practices. The operating leadership swiftly escalated the issue to the company’s global management board to decide whether specific contractors were acceptable. It was able to reallocate project tasks among contractors, manage timeline slippage and the budget, and consequently reduce the company’s employment-practices risk and safeguard project returns.

Companies with a culture that discourages such discussions—as well as those in which overconfidence leads to denial—are prone to ignoring or failing to recognize risks. In some cases, employees fear telling the boss bad news because they worry about the financial downside of slowing commercial progress, they know the boss doesn’t want to hear it, or they fear being blamed. As a result, they alert managers to risks only when further delay is impossible. ...

The best cultures actively seek information about and insight into risk by making it everyone’s responsibility to flag potential issues. ...

Ensuring respect for risk

Most executives understand the need for controls that alert them to trends and behaviors they should monitor, the better to mobilize in response to an evolving risk situation. And while managers are unlikely to approve of skirting the very guidelines and controls they have put in place, some unintentionally promote situations and behaviors that undermine them. For example, while too few controls can obviously leave companies in the dark as a situation builds, too many can be even more problematic. Managers in such cases mistake more controls for tighter management of risk, though they may be inadvertently encouraging undesired behaviors. ...

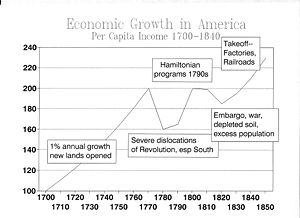

|

| English: Frame of reference for research of integrateg Governance, Risk & Compliance (GRC) (Photo credit: Wikipedia) |

Even companies with the right number of controls in place encounter difficulty if managers do not monitor related trends and behaviors. Companies often unconsciously celebrate a “beat the system” mind-set, rewarding people who create new businesses, launch projects, or obtain approvals for things others cannot—even if it means working around control functions in order to get credit lines or capital allocations, for example.

In the best of cases, respect for rules can be a powerful source of competitive advantage. A global investment company had a comprehensive due-diligence process and sign-off requirements for investments. Once these requirements were fulfilled, however, the board was prepared to make large, early investments in asset classes or companies with the collective support of the senior-executive team, which was ultimately accountable for performance. Company-wide confidence in proceeding resulted from an exhaustive risk debate that reduced fear of failure and encouraged greater boldness relative to competitors. Confidence also stemmed from an appropriately gauged set of risk controls and an understanding that if these controls were followed, failure would not be regarded as a matter of poor decision making.

Building an effective risk culture

Companies that want to reshape their risk culture should be aware that patience and tenacity are crucial. Changing the operating environment of a large organization takes at least two to three years, as individuals come up against specific processes—such as policy decisions, project approvals, or even personnel reviews—that have changed in line with new risk-culture principles. In our observation, companies wrestle with two challenges: building consensus among senior executives and sustaining vigilance over time.

Finding consensus on culture

Improving a company’s risk culture is a group exercise. ... In most global organizations, CEOs and CFOs who want to initiate the process must build a broad consensus among the company’s top 50 or 60 leaders about the current culture’s weaknesses. Then they must agree on and clearly define the kind of culture they want to build. This is no small task, typically requiring agreement on four or five core statements of values about the desired culture that imply clear process changes. ...

The consequence of committing to such statements is that the company will need to change the way it approves activities, whether those are transactions at banks, capital projects in heavy industry, or even surgical procedures at hospitals. It cannot let them proceed if the risk infrastructure does not support them—and business-unit COOs must be held accountable for risk events related to infrastructure in their areas. To make aspirations for the culture operational, managers must translate them into as many as 20 specific process changes around the organization, deliberately intervening where it will make a difference in order to signal the right behavior. In some companies, this has meant changing the way governance committees function or modifying people processes, such as training, compensation, and accountability. And while fine-tuning some of these areas may take a fair number of cycles, even a few symbolic changes in the first cycle can have a profound impact on the culture. ...

Sustaining vigilance

Since cultures are dynamic by definition, sustaining the right attitudes and behaviors over time requires continuing effort. An ongoing risk committee might start off by keeping on top of key issues but become stale and mechanical as people lose energy over time. Or a discontinuity—new leadership or a new set of market pressures, for instance—could send the culture in a different direction. ...

The responsibility for maintaining the new risk culture extends to boards of directors, which should demand periodic reviews of the overall company and individual businesses to identify areas that merit a deeper look. This need not be complicated. Indeed, most companies can aggregate existing data: a people survey, which most companies conduct, can provide one set of indicators; a summary of operational incidents, information on financial performance, and even customer complaints can also be useful. Combined, these data could be displayed in a dashboard of indicators relevant to the company’s desired risk culture and values. Such a review process should become part of the annual risk strategy on which the board signs off.

Obviously, a shortage of risk consciousness will lead to trouble. But it is all too easy to assume that a thorough set of risk-related processes and oversight structures is sufficient to avert a crisis. Companies cannot assume that a healthy risk culture will be a natural result. Rather, leadership teams must tackle risk culture just as thoroughly as any business problem, demanding evidence about the underlying attitudes that pervade day-to-day risk decisions.

About the authors

Alexis Krivkovich is a partner in McKinsey’s San Francisco office, and Cindy Levy is a partner in the London office.

Share

Share