June 24, 2013

This is another of my continuing articles on 401(k) In-Plan lifetime income products.

- The Next Big Thing for 401(k) Plans?

- Understanding Sponsors’ Concerns about In-401(k) In-Plan Life-Time Income Products

But let’s ditch the productization label, and refer to what’s happening with lifetime income concerns as the “annuitization of 401(k) plans.”

Here’s one of the basic concerns employers have with 401(k) annuities – fiduciary responsibility for the selection of an annuity provider or contract for benefit distributions.

|

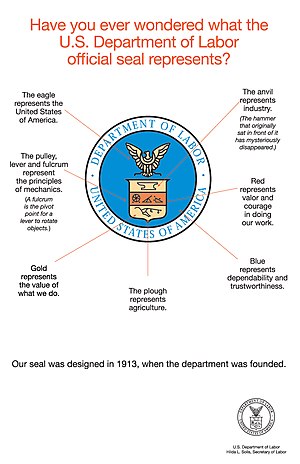

| The seal of the United States Department of Labor (Photo credit: Wikipedia) |

- Engaging in an objective, thorough and analytical search for the purpose of identifying and selecting providers from which to purchase annuities;

- Appropriately considering information sufficient to assess the ability of the annuity provider to make all future payments under the annuity contract;

- Appropriately considering the cost (including fees and commissions) of the annuity contract in relation to the benefits and administrative services to be provided under such contract;

- Appropriately concluding that, at the time of the selection, the annuity provider is financially able to make all future payments under the annuity contract and the cost of the annuity contract is reasonable in relation to the benefits and services to be provided under the contract; and

- If necessary, consulting with an appropriate expert or experts for purposes of compliance with the provisions of this process.

|

| The seal of the United States Department of Labor (Photo credit: Wikipedia) |

But remember, the so-called “Safe Harbor” does not by itself protect a fiduciary from its responsibility for selecting an annuity provider or contract. A Safe Harbor, in general, only reduces or eliminates a party’s liability if the party performed its actions in good faith or in compliance with defined standards.

So from a practical standpoint: a Prudent Fiduciary should consider hiring a Prudent Expert.

Jerry Kalish is President of National Benefit Services, Inc., a Chicago-based TPA firm. He has been publishing the firm’s Retirement Plan Blog since 2006. He can be reached at jerry@nationalbenefit.com.

This article is for information purposes and should not be considered tax or legal advice. Plan sponsors and participants should consult with qualified tax and legal advisors for the application of the law and regulations to their specific situations.

'via Blog this'

No comments:

Post a Comment