MICHAEL HESS /

MONEYWATCH/ January 29, 2013, 8:56 AM

DAYMOND John

(MoneyWatch) Celebrated entrepreneur Daymond John knows how to use his money to make more money: He mortgaged the home he shared with his mother to seed his FUBU clothing brand, turning a street-corner business into a fashion powerhouse with annual sales of more than $350 million. But John also knows that no matter how much money he makes, he can't make more time.

|

| English: This is a photo of Daymond John, FUBU CEO, speaking at an event. (Photo credit: Wikipedia) |

Recently I had a conversation with John about his views on using and investing his time, along with about how he maintains that discipline now that he is involved in a variety of businesses and other pursuits.

The time return of self-employment can be hard to measure

|

| English: Photo of Red Lobster restaurant in Baton Rouge, LA that demonstrates the new restaurant style of the chain. (Photo credit: Wikipedia) |

The lesson: The return on time invested can be misleading; you must understand what your time is really producing, just as you look at a financial statement to see what your dollars are generating.

It's easy to fall into the trap of being too busy for your own good

After starting FUBU, ... John lived and breathed his business 24/7. But it took a toll on his personal life. "By my early thirties I'd already paid a heavy price in terms of my family situation," John said, "and I really had to take a hard look at all the ways I was spending my time."

... John realized there were chunks of time that weren't productive. As an example, he pointed out that he was wasting an hour and a half every day sitting in Manhattan traffic, so he moved closer to his office and reclaimed the better part of a full working day every week.

The lesson: Being "too busy" can often be a self-fulfilling prophecy, and most people can find or make the time they need to do the things that are important to them. Make sure you aren't making sacrifices you don't necessarily have to make.

Having more control of your time doesn't mean you're making better use of it

... John learned that the fruits of his labor brought new time challenges. With wealth came the acquisition of stuff, and that stuff often made unexpected demands on his time. ...

The lesson: Success buys many things, including more freedom to decide how you spend your time. But it's still your time, and it should still generate a return for you. The return might be financial, or it might be enjoying what you've earned; either way, make sure your time is giving you what you want and expect.

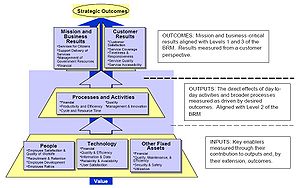

Today, John segments the allocation of his time and money into three general categories. The easiest investments are completely hands-off: As John says, "The stock market doesn't require any of my time, so if I'm considering that kind of investing, it's only a financial decision."

Next come equity investments like those pitched on Shark Tank. ... As he told me, "If my time is part of the deal, I will only consider it if my specific experience and expertise will very clearly add business value." ...

Finally, there are his own companies, where John remains every bit the entrepreneur. He makes it clear that his time commitments are inevitably and directly related to the level of financial investment, risk, and accountability: "Anything I own 100% of will always come first, and will always get whatever time is needed, no question."

'via Blog this'

Al Lewis, widely credited with inventing the discipline of disease management (as currently defined), is president of the

Al Lewis, widely credited with inventing the discipline of disease management (as currently defined), is president of the  CFO.com

CFO.com

Larry S. Chapman is president and CEO of Chapman Institute, which provides a certification program for worksite wellness practitioners.

Larry S. Chapman is president and CEO of Chapman Institute, which provides a certification program for worksite wellness practitioners. CFO.com

CFO.com