Growing Your Empire Newsletter

By Paul Lemberg

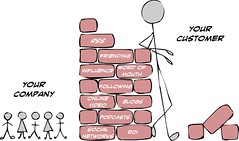

It's hard to avoid certain mistakes, especially when you face a situation for the first time. In fact, many of the following mistakes are hard to avoid even if you're an old hand. Of course, these are not the only mistakes CEOs make, but they sure are common enough. …1. Big Customer Syndrome

If more than 50 percent of your revenues come from any one customer you may be headed for a meltdown. … [You] are so busy servicing that one big account that you fail to develop additional customers and revenue streams. Then suddenly, for one reason or another, that customer goes away and your business borders on collapse.

Use that burgeoning account as both a cause for celebration and a danger signal. Always look for new business. And always seek to diversify your revenue sources.

2. Creating products in a vacuum.

Image by ronploof via FlickrYou and your team have a great idea. … When you finally bring it to market, no one is interested. Unfortunately you were so in love with your idea you never took the time to find out if anyone else cared enough to pay money for it. …

Image by ronploof via FlickrYou and your team have a great idea. … When you finally bring it to market, no one is interested. Unfortunately you were so in love with your idea you never took the time to find out if anyone else cared enough to pay money for it. … … Do the market research up front. … Talk to potential customers, at least a dozen of them. … If enough people say "yes" go ahead and build it. Better yet, sell the product at pre-release prices. Fund it in advance. If you don't get a good response, go on to the next idea.

3. Equal partnerships

Suppose you are the world's greatest salesman, but you need an operations guy to run things back at the office. Or you are a technical genius, but you need someone to find the customers. Or maybe you and a friend start the company together.

In each case, you and your new partner split the company 50/50. That seems fine and fair right now, but as your personal and professional interests diverge, it is a sure recipe for disaster. Either party's veto power can stall the growth and development of your company, and neither holds enough votes to change the situation.

Almost as bad is ownership split evenly among a larger number of partners, or worse, friends. … No one has the final say, every little decision becomes a debate, and things bog down quickly.

4. Low prices

Some entrepreneurs think they can be the low price player in their market and make huge profits on the volume. Would you work for low wages? Why do you want to sell at low prices? … Remember, low margins = no profits = no future. So the grosser the better.

Set your prices as high as your market will bear. Even if you can sell more units and generate greater dollar volume at the lower price (which is not always the case) you may not be better off. … Figure all your incremental costs. Figure in the extra stress as well. For service companies, low price is almost never a good idea. How do you decide how high? Raise prices. Then raise them again. When customers or clients stop buying, you've gone too far.

5. Not enough capital

… Regardless of the cause, many businesses are simply undercapitalized. Even mature companies often do not have the cash reserves to weather a downturn.

Be conservative in all your projections. Make sure you have at least as much capital as you need to make it through the sales cycle, or until the next planned round of funding. Or lower your burn rate so that you do.

6. Out of Focus

… [Many] entrepreneurs - hungry for cash and thinking more is always better - feel the need to seize every piece of business dangled in front of them, instead of focusing on their core product, service, market, distribution channel. Spreading yourself too thin results in sub-par performance.

Concentrating your attention in a limited area leads to better-than-average results, almost always surpassing the profits generated from diversification. …

… Don't spread yourself thin. Get known in your niche for the thing you do best, and do that exceedingly well.

Image via Wikipedia7. First class and infrastructure crazy

Image via Wikipedia7. First class and infrastructure crazy… Spend all the money really necessary to achieve your objectives. Ask the question, will there be a sufficient return on this expenditure? Everything else is overhead.

8. Perfectionitis

… Finishing the last 20 percent of the last 20 percent could cost you more than you spent on the rest of the project. When it comes to product development, Zeno's paradox rules. Perfection is unattainable and very costly at that.

Plus, while you're getting it right, the market is changing right out from under you. On top of that, your customers put off purchasing your existing products waiting for the next new thing to roll out your doors.

… Focus on creating a market-beating product within the allotted time. … Know when you have to stop development to make a delivery date. When your time's up, it's up. Release your product.

Image via Wikipedia9. No clear return on investment

Image via Wikipedia9. No clear return on investment… Talk to your customers, create case studies. Come up with ways to quantify the benefits. … If you can demonstrate the great return on investment your product provides, sales are a slam dunk.

10. Not admitting your mistakes.

… At some point you realize the awful truth: you have made a mistake. Admit it quick. Redress the situation. … Sometimes this is hard, but, believe me, bankruptcy is harder.

Assume your costs are sunk. Your money is lost. There is good news: your basis is zero. From this perspective, would you invest fresh money in this idea? If the answer is no, walk away. Change course. Whatever. But do not throw any more good money after bad.

OK, everybody makes mistakes. Just try to catch them quickly, before they kill your company.

***

Paul Lemberg helps small business owners become wealthy. Since 1995, Paul has helped hundreds of small business owners achieve outstanding success. He has written three books, including Faster Than the Speed of Change, Earn Twice As Much with Half The Stress (co-authored with Tom Matzen), and his latest, the business best seller, Be Unreasonable. On television, Paul has appeared on Good Morning America, CNN, Financial News Network, and dozens of national radio programs. His work has been featured in over eighty magazines and publications including the New York Times and the Los Angeles Times, as well as the world's largest circulation newsletter, Bottom Line Personal. You can learn more about Paul at http://www.paullemberg.com/.

No comments:

Post a Comment