CFO Magazine:

Gregory V. Milano, Joseph Theriault

academics, and commentators to suggest that levering up the balance sheet by taking on more debt financing is beneficial for shareholders. Our capital-market research suggests otherwise....

The appeal of debt originates in university corporate-finance classes where students are taught that an important driver of shareholder value is to minimize the weighted average cost of capital (WACC) based on the proportions and costs of debt and equity capital. The U.S. tax code allows a deduction for interest payments, so WACC tends to be lower for more highly levered companies, as long as the risk of financial default doesn’t become excessive. A lower WACC increases the calculated present value of anticipated future cash flow, which is projected to increase the share price.

Theoretical corporate finance aside, a behavioral argument suggests that debt disciplines the otherwise free-spending ways of management. It is said to reign in capital spending, improve cost efficiency, and lead to superior performance.

...Yet our research shows that highly levered companies tend to deliver lower returns to shareholders.

We started with the 1,000 largest nonfinancial U.S. companies and eliminated those without full financial and market data for 2001 through 2010, which left us with 512 companies. We separately explored two subsets of time to examine different points in the economic and credit cycle.

Simply sorting companies based on leverage seemed to produce industry distortions: some industries tend to use either more or less debt. In fact, some of the industries that deliver the highest total shareholder return (TSR) based on dividends and share price appreciation also happen to be those that tend to use less debt. That is true for food retailing, pharmaceuticals and biotechnology, software, and technology hardware.

| Understanding Financial Leverage (Photo credit: Wikipedia) |

The analysis was repeated for 2008 through 2010, when credit was less available, credit spreads were generally higher, and the use of debt was more highly scrutinized by investors. As expected, highly leveraged companies performed even worse during this tighter credit period by delivering annual TSR 1.7% lower than their less-leveraged peers.

As also expected, during the credit boom from 2004 through 2006, highly levered companies performed better with 1.2% higher TSR per year.

Over the full 10 years, leverage had a negative impact, ... Does this imply the theory behind WACC and its impact on valuation are wrong? We do not think so, but we do question the behavioral implications of carrying higher debt levels.

A close examination of performance shows those with higher debt tend to deliver 3% lower revenue growth per year than the less-leveraged companies in the same industry. ...[We] have demonstrated a strong linkage between revenue growth and TSR for both the market as a whole and for many specific industries, so revenue growth is an important point of differentiation in value creation.

Indeed, the failure of higher leverage to lead to higher TSR may not be due to a misinterpretation of how leverage affects valuation but rather the misconception that managerial behavior is unaffected by leverage. Perhaps at least some companies carrying more debt are more conservative in their strategies and this leads to less revenue growth, and that’s why share-price performance is no better despite the tax benefits that reduce WACC.

... Can leverage be beneficial? We believe it can be in a limited number of cases where desirable reinvestment in the future is not readily available.

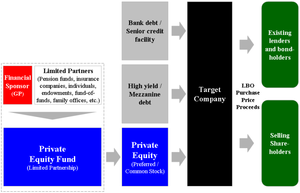

| English: Diagram of leveraged buyout transaction structure for Private equity, Leveraged buyout (Photo credit: Wikipedia) |

But for most companies, increasing leverage tends to make management more conservative, which seems to reduce the propensity to be strategically opportunistic ... Leverage constricts revenue growth, which leads to worse share-price performance on average.

Despite the touted benefits of leveraging up the balance sheet, most companies would deliver better share-price performance over time if they were more prudent with the amount of leverage taken on.

Gregory V. Milano, a regular CFO columnist, is the co-founder and chief executive officer of Fortuna Advisors LLC, a value-based strategic advisory firm. Joseph Theriault is an associate at the firm.

nice blog.......... Finance for Non-financial

ReplyDelete