The new law, which loosens reporting requirements for smaller businesses, has prompted some companies to actually add information to their regulatory filings.

CFO MagazineSarah Johnson

In the run-up to Facebook’s initial public offering, which is expected to happen within days, smaller, lesser-known companies are preparing for their own foray onto U.S. stock exchanges as well. Naturally, they are alerting investors in public filings that their small stature and lack of public-company experience can make investing in their stock a risky endeavor. Some are going even further and emphasizing that the Jumpstart Our Business Startups (JOBS) Act is itself a risk factor.

|

| Seal of the U.S. Securities and Exchange Commission. (Photo credit: Wikipedia) |

The trend may reflect an unintended consequence of the JOBS Act, which lawmakers hope will lead to a more active IPO market, according to Michael Stocker, a partner at law firm Labaton Sucharow, who represents institutional investors. The filings are saying “that because the companies are willing to take advantage of the related standards for disclosures under the JOBS Act, one real risk is that they will be punished by investors, since investors won’t be getting as much information and they may have less confidence in how the companies are doing,” says Stocker.

|

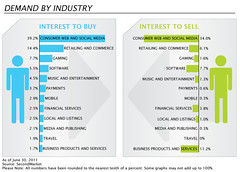

| What investors want (Photo credit: tjohansmeyer) |

… Not all companies preparing for an IPO that qualify as emerging-growth companies have included the law as a risk factor.

|

| Logo og McDermott Will & Emery (Photo credit: Wikipedia) |

The additional disclosure implies the company using it is trying to be comprehensive. Moreover, the lines of text may help it later on if it runs into trouble. “If an emerging-growth company has a failure of its controls and has to restate its financial statements, the disclosure is going to be a plus when that company defends itself against a lawsuit,” Murphy says. The business can respond by saying, “We warned you that there weren’t auditors looking independently at this.”

The plaintiffs’ bar could have a retort, however, Stocker suggests. “All the disclosure says is that because of the JOBS Act, the company’s stock may not trade as high a volume or [for as] good a price as you may hope,” he says. “It’s not saying because of the JOBS Act you may get a nasty surprise at the end of five years.”

No comments:

Post a Comment