June 25, 2012

CFO Magazine

Russ Banham

|

| English: Barack Obama signing the Patient Protection and Affordable Care Act at the White House (Photo credit: Wikipedia) |

It’s impossible to know which way the court will vote on the mandate, but many observers predict a 5-4 ruling, one way or the other. If the court upholds the mandate, … compliance with its multiyear litany of reforms will continue for both health insurers and employers. If not, the court could rule that other parts of the legislation must fall, including elements companies have already complied with… .

The government contends that if the mandate is unconstitutional, only the community-rating and guaranteed-issue provisions must fall. The former requires that all policyholders in an area or “community” pay the same premium, regardless of their personal health, age, gender, or other factors. The latter provision eliminates discrimination by insurers based on a person’s health status.

The plaintiffs in the case, including 26 states, argue that without the individual mandate, the entire law must be struck down.

|

| Maximum Out-of-Pocket Premium Payments Under PPACA (Photo credit: Wikipedia) |

It’s likely that without the mandate, any remaining features of the law would suddenly cost more. “The mandate brings more than 30 million uninsured people, most of them young and healthy, into the health-insurance market,” explains Shawn Nowicki, director of health policy at nonprofit health-insurance exchange HealthPass New York. That population is not likely to use the health-care system much or be a cause of big medical-cost increases. “As ‘good risks,’ they would bring down rates for insurers and the average premiums paid by employers. If that giant enrollment is gone, the other reforms hinged to the mandate would be out of balance and cost more.”

|

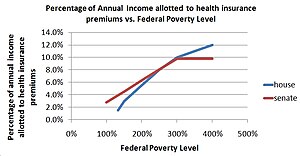

| English: House Bill and Senate Bill subsidies for health insurance premiums. (Photo credit: Wikipedia) |

The financial shortfall from losing the 30 million new insureds could be at least partly mitigated by new laws raising both the No Coverage and Free Rider penalties levied against employers under the Act. …“To continue the subsidies, the government may simply raise the employer penalties to make up the difference,” says Wojcik.

If the mandate is ruled unconstitutional but the rest of the law remains intact, the Obama Administration might propose other methods of avoiding adverse selection (which, in this context, would be a scenario where people with high-cost medical profiles comprise a disproportionately large segment of the insured population).

“We might see a late-enrollment penalty for individuals, in addition to the Free Rider and No Coverage penalties,” says J.D. Piro, senior vice president at Aon Hewitt, where he leads the health-law consulting group Piro. “But frankly, if the President and Congress had a better idea than the individual mandate, they would have come out with it. Without it, everything is subject to scrutiny and revision.”

Employee Pain

Meanwhile, if the mandate is ruled unconstitutional and, as a result, the entire law falls, employers will have to make some tough decisions regarding provisions of the Act they’ve already complied with that are popular with employees. These include requirements that employer-sponsored insurance cover dependent children through age 26 as well as everybody with preexisting conditions, and a prohibition on lifetime dollar caps for essential benefits like hospital stays.

|

| English: (Photo credit: Wikipedia) |

… “Even without the mandate, many will continue to offer it because we’re not talking about a lot of money, given the youth and health of that population,” predicts William Sarraille, a partner and health-care group leader at law firm Sidley Austin LLP.

“Insuring people with preexisting medical conditions and lifetime caps, on the other hand, is pretty darn expensive,” Sarraille continues. “Maybe states will take that on in the health-insurance exchanges many of them are developing. I’m not optimistic about that, but for large employers it will definitely be financially problematical.” …

Whatever decisions companies make, “they need to ensure that their health plan aligns with both their talent objectives and employees’ expectations,” says Arthur Tacchino, associate professor of health insurance at The American College, an insurance-education institution.

Cutting Costs

What else should employers be doing now to prepare for the possibility of the individual mandate dying on the vine, not to mention the vine itself perishing? … “If you decide to eliminate preexisting conditions, you need to explain why — that you’ve analyzed the cost and it just isn’t feasible,” Sarraille says. “But maybe you can continue with things you can afford, such as dependent-children coverage.”

|

| English: Parran Hall, home to the University of Pittsburgh Graduate School of Public Health. (Photo credit: Wikipedia) |

… Tanvir Hussain, a Los Angeles–based cardiologist and former adjunct professor of bioethics at Pepperdine Law School, wants employees to be held more accountable for their health. “By incorporating stronger incentive frameworks into employer-sponsored plans, companies can reduce health-care costs and minimize lost productivity due to illness,” he asserts.

… “Health-care choices are traditionally thought of as personal,” he says, “but maybe they shouldn’t be when they affect others in such a significant way.”

That point has little to do with partisan rhetoric or legal wrangling, and some employers are on to it. Whole Foods, for instance, provides discounts to its supermarket employees for lowering their BMI (body mass index), and The Cleveland Clinic recently made news for its new policy of hiring only nonsmokers. As Hussain sees it, “These are health-care reforms that companies can make on their own,” mandate or no mandate.

Solomon-Like Decisions

Even if the Supreme Court upholds the individual mandate, tough decisions would be in store for employers. The Act’s nuances, particularly in relation to health-plan costs, invite a wide range of corporate responses. Consequently, best practices will take time to form around ways to contain plan expenses and still preserve the value of health insurance as a means of attracting, motivating, and retaining top-notch talent.

… “Companies that have been holding back on employment and investment decisions would now know what to plan for,” says Wojcik.

From a cost standpoint, those plans might include hiring fewer employees or replacing full-time workers with part-time help, as the law does not require health insurance for the latter. A similar cost-effective strategy might be hiring more skilled workers outside the United States. “When you add rising health-care costs to the talent squeeze going on in the United States, it’s simply less attractive to create jobs here,” says Helen Darling, chief executive of the NBGH.

Such decisions are particularly difficult given the potential for political backlash. Less-divisive ways to harness plan expenses include carefully choosing among the growing types of health-care delivery models, partnering with health-care providers to pare rising costs through more automated payment processes, shifting some cost burdens onto employees via deductibles and co-payment strategies, and skillfully negotiating with providers to reduce premiums.

Exchanges to the Rescue?

Smaller employers, those with 100 or fewer employees, will be able to choose among the federally subsidized, private health-insurance exchanges that are scheduled to become operational in at least two dozen states by 2014. These quasigovernmental entities are designed to provide health insurance more cost-efficiently.

Larger employers can use the exchanges come 2017. …And, since employers’ dealings with insurers through the exchanges will be transparent, large employers can begin leveraging that information in their own negotiations with insurers starting in 2014.

The exchanges are designed with four tiers of coverage, each priced accordingly. Determining which plan is right requires balancing the cost against the impact on human capital.

“You can probably measure the impact on talent retention from choosing the lowest-cost plan and gauging how many employees might leave the company and the average turnover costs that represents,” says Tacchino. “But it’s going to be tough to put a number on morale and productivity. A key employee might feel the company is no longer investing in him or her and start working less diligently. Employers have to weigh such possibilities in their decisions.” …

Lessons from the Past

Assisting such deliberations are the lessons learned in Hawaii and Massachusetts, each with insurance mandates similar to those in the Act. Hawaii’s mandate, for instance, requires that private-sector employers provide health-insurance coverage to employees working at least 20 hours per week on a regular basis. Only 8% of Hawaiians currently lack insurance, compared with 15% nationally.

“When the Hawaii law was passed in 1974, concerns arose that it would compel employers to lower wages as a cost-effective response to the financial burden. But that did not happen,” says Nancy Sayre, assistant chair of the department of health professions at Metropolitan State University of Denver, where she teaches health economics. What occurred instead was an increasing reliance by employers on part-time workers exempt from the law.

Wojcik postulates a similar response nationally, assuming the Act remains intact. “Companies know the cost of labor will go up if the individual mandate is upheld, and they will decide whether to hire fewer people, though if they’re in an industry where they can shift to more part-time employees, they probably will do that,” he says.

Some companies may simply decide to forgo providing health insurance to their employees and suffer the

Act’s No Coverage penalty. This “pay-or-play” tax, … is easy to calculate — the number of full-time employees minus 30, times $2,000 per worker. The Boston Globe recently presented anecdotal evidence indicating that many employers in Massachusetts, which imposes a comparatively low $300 penalty per uninsured employee, are eliminating health coverage and paying the fines instead.

Other employers may temporarily opt out, analyze the outcome, and reverse course. Still others may wait to see what competitors do.

Also easy to measure is the Act’s Free Rider penalty of $3,000 per employee for providing a health-insurance plan deemed to be of low value and unaffordable. More difficult to measure is the impact on talent recruitment, productivity, and retention, not to mention the reputational repercussions of no longer providing health benefits.

Meanwhile, there is another important wrinkle to the individual mandate; indeed, to the entire Act: the fact that this is an election year. If Republicans take the White House and the Senate and, as they’ve vowed, repeal much of the legislation, whether they will maintain the more popular provisions of the Act is open to debate.

“In a lame-duck session where political compromises have to be made, perhaps even die-hard Republicans will give an inch on certain reforms in return for Democratic pullbacks on the Bush tax cuts and automatic cuts to military spending,” Sarraille says.

Darling offers another take: “Even if the Republicans don’t succeed in repealing ‘Obama-care,’ as they call it, they can still play a lot of mischief.”

No comments:

Post a Comment