Oh, you’re doing that already? And you’re wasting time managing accounts payable every day, tracking down approvals for purchases you don’t understand? Here’s how small companies can tackle purchasing inefficiencies.

CFO.comDavid Rosenbaum

|

| Image via CrunchBase |

…Because the company was small, it had little leverage with vendors and limited ability to negotiate for lower prices or early-payer discounts. Therefore, focusing attention on processes and spend — for supplies, services, and the like — didn’t seem worth the bother; it wouldn’t much affect the bottom line. So no one focused.

But by 2009, when Blade had tripled to about 150 full-time employees, its paper-based process — people throwing requisitions over Verbeck’s wall for approval — forced him to start asking questions and saying no more frequently. …

|

| Image via CrunchBase |

Sweating the Small Stuff

When times are good, when credit easy to come by and everyone is fat, no one sweats the small stuff. …[Today] the small stuff looms large, especially in small businesses trying to grow at a time when investors and customers are wary.

The savings that can be retrieved by automating and rationalizing approval and purchasing processes are palpable (a 2009 Aberdeen Group study estimated that “improving the percentage of all non-payroll, tax, tariff, and fee-related spend” — that is, indirect, nonstrategic expenses — brought under the management of a dedicated group can help enterprises “achieve a 5% to 20% cost savings for each dollar brought under spend management”). But the real value, says Kristen Lampert, corporate-services manager at specialty-investment bank Ziegler, is de-risking organizational spending by making sure the approval chain has the right people weighing in on the right things.

|

| Workflow/Business Process Management (BPM) Service Pattern (Photo credit: Wikipedia) |

She describes an invoice for a software service “that should have had oversight by the IT director,” but instead was approved by multiple, siloed business units. The lack of communication lead to the bank paying for some services that were supposed to have been cancelled.

Lampert established a work group to design a request-for-proposal for a software service to rationalize the company’s processes. Her argument was that if the company could save 1% of the $16.5 million she managed annually, getting all spending in one bucket, the return on investment would be positive.

The group began by defining the organization’s must-haves: something easy to use …; the ability to manage contracts; an easy-to-configure approval chain; supplier network capability, and electronic links from Ziegler’s system to its suppliers’ e-commerce sites for electronic catalog purchasing (known as punch-out support). After researching 18 solutions, Ziegler chose [vendor], a software-as-a-service tool Lampert expects will be easy to integrate with the new general ledger the bank is in the process of picking.

|

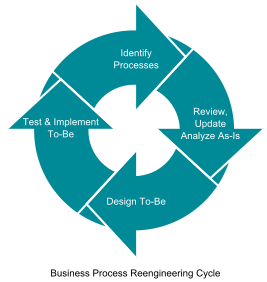

| English: Business Process Reengineering Cycle (Photo credit: Wikipedia) |

Navigating the Vendor Landscape

According to a 2011 Gartner report, the e-procurement vendor landscape is “fragmented and rapidly evolving,” so finance executives need to perform due diligence when choosing a vendor and service that fits their organization’s budget and needs. Vendors in the space include Ariba, with its relatively large-company clientele and broad supplier network; Basware; and Coupa, which grew up in the small-to-midsize business space, and ranked highly in Gartner’s study for ease of use and customer satisfaction. And that’s only the A-B-C of the list of 42 vendors Gartner analyzes.

Coupa’s Verbeck asserts that the company’s cloud-native DNA enables it to evolve rapidly and allows users a great degree of freedom in creating “dynamic approval processes.” “That’s hard to do in a paper-based world,” he says.

With paper processes, a staffer is more likely to just circumvent the procurement system, as did one manager Verbeck spoke to who, when he discovered the purchase of a stapler was going to the CFO for approval, just bought the item off-contract and expensed it.

“Part of the miracle of the SaaS model,” says Verbeck, is that users can extend the functionality of the software — configuring it to their needs — without having to rework the software’s base code. In practical terms, that means users can alter the approval chain as needed without calling in the vendor to redesign (at great expense) the software.

But software doesn’t solve business problems: people solve business problems. “I could have put Coupa in place and not solved the problem,” says Verbeck, recalling his Blade days. The software would have just “paved the cow path” (automated a business process without addressing whether it was efficient). Instead, he began by blowing up Blade’s existing processes.

“Instead of requisitions going through the management hierarchy, we created approval chains based on who was buying, what they were buying, who they were buying it for, how much they were spending, and whether the item had been bought before. This process ended up with people approving things they had knowledge about. I explained to the managers that in this new world, they were accountable. If something landed on my desk that I had to reject, that was their problem.”

And Verbeck was no longer the bad guy.

Good information about Spend Management, here is also some useful information about Spend Management

ReplyDelete