A life insurance retirement plan can give your clients the tax-free advantages of a Roth IRA — with fewer hassles.

Life Insurance Selling magazineBY DAVID C. MCKNIGHT

JUNE 1, 2012 • REPRINTS

Americans are watching with a growing sense of dread as our nation’s debt levels continue to spiral out of control. …

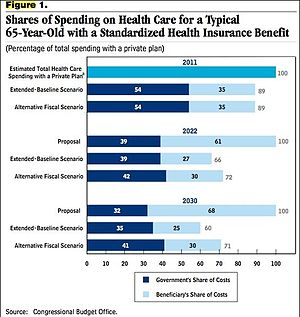

Today, the federal government spends 76% of the federal budget on just four things: Medicare, Medicaid, Social Security and interest on the national debt. Absent serious efforts on the part of Congress, those costs are set to climb to 92% of the federal budget by the year 2020.1

This huge increase will be fueled in large part by the exodus of our nation’s 78 million baby boomers out of the workforce and on to the rolls of our entitlement programs. In order to offset these costs, tax rates would have to rise dramatically.2 In fact, David Walker, a former federal comptroller general, has calculated that taxes would have to double immediately in order to sustain our ever-increasing debt load.3

|

| Grand Slam Life Insurance Plan (Photo credit: Wikipedia) |

The L.I.R.P. advantage

A L.I.R.P. is an accumulation tool that shares many of the tax-free attributes of traditional retirement accounts, such as the Roth IRA. Not only are distributions 100% tax-free, but they also do not contribute to the income thresholds that trigger the taxation of Social Security. When utilized properly, the L.I.R.P. has additional attributes that make it a surprisingly attractive alternative for tax-free retirement accumulation.

|

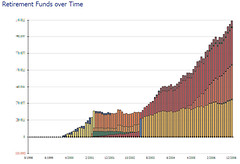

| Retirement Funds over Time (Photo credit: RodBegbie) |

No contribution limits: Currently, the IRS restricts the amounts that can be contributed to tax-free accumulation accounts, such as the Roth IRA. In 2012, those who are under age 50 can contribute $5,000 per year, while those over 50 can contribute $6,000 per year. There are no such limitations with the L.I.R.P. …

No legislative risk: … If history serves as a model, however, the L.I.R.P. will likely be immune to the impact of tax law changes. When Congress changed the rules on the L.I.R.P. in 1982, 1984 and 1987, existing L.I.R.P. arrangements continued to be taxed under the old laws. Such grandfather clauses give the L.I.R.P. a much longer shelf life than traditional tax-free alternatives.

Multiple accumulation strategies: Another benefit of the L.I.R.P. is the flexibility it provides in choosing how to grow dollars within the tax-free accumulation account. Clients can choose between one of three basic accumulation strategies at the outset of the program. Determining the right one for your clients will depend on their individual goals and objectives.

1. Insurance company investment portfolio: … Because insurance companies are in the business of managing risk, these types of returns tend to be safe but very modest. Typical returns can range anywhere from 3% to 5%.

2. Stock market: Alternatively, clients can pass their contributions through insurance companies and into mutual fund portfolios called sub-accounts. While this approach can provide much higher returns, it exposes clients to the impact of severe market declines. …

3. Index: In this arrangement, clients contribute dollars to an accumulation account whose growth is linked to the upward movement of a stock market index, like the S&P 500. Clients participate in the growth of this index up to a cap, typically between 13% and 15%. On the flip side, if the index ever loses money, the account is credited zero. With back-tested historical returns of between 7% and 9%, this can be a safe but productive way to accumulate tax-free dollars for retirement.

|

| Internal Revenue Service (IRS) (Photo credit: cliff1066™) |

To many, the L.I.R.P. sounds like the perfect tax-free retirement tool. Some might ask, “Why not put all of our clients’ money into the L.I.R.P.?” For starters, it’s never a good idea to have all of your eggs in one basket. We diversify our clients’ investments; we should likewise diversify their streams of tax-free income.

Second, in exchange for nearly unlimited tax-free savings, the IRS requires that [out] flows, on a monthly basis, the cost of term life insurance. However, many life insurance companies recognize that clients approaching retirement may not have a glaring need for term life insurance. So they’ve done something to sweeten the pot.

Many life insurance companies now offer a provision whereby clients can access death benefit proceeds prior to death for the purpose of paying for long-term care. This is a compelling alternative to traditional long-term care insurance policies, where clients pay premiums for protection they hope they never have to use. When clients utilize the L.I.R.P. to cover long-term care risks, they do pay for it, but if they die never having needed it, their heirs still receive a tax-free death benefit.

|

| Ryan-Graph (Photo credit: Wikipedia) |

However, unless the L.I.R.P. is structured correctly, the expenses can overwhelm the growth inside the accumulation account. In order to maximize the impact of the L.I.R.P. strategy, a client must purchase the minimum insurance required while contributing the maximum amount allowed under IRS guidelines. If properly structured, the expenses within the plan can cost as little as 1% of the annual account balance over the life of the program.4 That’s less than the average annual expenses in the typical 401(k).5

The L.I.R.P. is a surprisingly flexible retirement vehicle with attributes that make it unique among tax-free accumulation tools. When utilized properly, it can play a crucial role in helping your clients insulate their assets from rising taxes while protecting them from the impact of premature death or long-term care.

Footnotes:

1. “Running the government on 8 cents,” Jeanne Sahadi, CNNMoney.com, Jan. 21, 2011

2. “Long-Term Economic Effects of Some Alternative Budget Policies,” Congressional Budget Office, May 19, 2008, 8-9, http://www.cbo.gov/ftpdocs/92xx/doc9216/05-19-LongtermBudget_Letter-to-Ryan.pdf

3. “Commentary: Why your taxes could double,” David M. Walker, CNNMoney.com, June 15, 2009

4. An equity indexed-based L.I.R.P., at preferred rates, using a minimum non-MEC face amount of $173,161, an increasing death benefit option, a $10,000 annual premium for 15 years, and an 8% rate of growth, has an internal rate of return in year 25 of 6.99%, or average annual fees of 1.01%.

5. “Are fees draining your 401(k) retirement savings?,” Christine Dugas, USA Today, Aug. 25, 2009.

No comments:

Post a Comment