|

| U.S. Supreme Court building. (Photo credit: Wikipedia) |

Some of the taxes affect high-income individuals. Others will come directly from companies in health industries such as pharmaceutical makers, medical-device manufacturers and health insurers.

"In this whole uncertain environment, it's one piece of the puzzle where we'll start to get some clarity" around taxes for individuals and companies, said Edward Karl, vice president of taxation for the American Institute of Certified Public Accountants in Washington. "We can start to remove some of the clouds that are following us around this year."

Unearned Income

The largest taxes on individuals in the Patient Protection and Affordable Care Act are scheduled to take effect at the beginning of 2013. Married couples earning more than $250,000 a year and individuals earning at least $200,000 face a 3.8 percent tax on their "unearned income," including capital gains, dividends and private-equity managers' profits on leveraged buyouts. Those high earners would be subject to an additional 0.9 percent levy on their wages exceeding those income thresholds starting next year. …

An estimated 4.1 million households, or 2.4 percent of Americans, would pay one or both taxes, according to the Tax Policy Center, a nonpartisan research group in Washington.

‘Big Deal'

"The 3.8 percent Medicare tax is a big deal" for wealthy investors because of the variety of unearned income it covers, said Elizabeth Kessenides, a tax attorney in New York who represents people in financial services including private-equity and hedge-fund managers. "For private-equity fund managers, it was a significant item due to its potential application to the carried interest."

The share of profits private-equity managers receive from investments is known as carried interest. It is often taxed as capital gains, which carry a lower rate than ordinary income and would fall under the new Medicare levy, Kessenides said.

"It could have some people triggering capital gains that they were thinking about doing next year," said Tim Steffen, director of financial planning at Robert W. Baird & Co. based in Milwaukee. "That's the most obvious repercussion."

High-income taxpayers considering large transactions with capital gains such as selling a business or second home have more reason to close deals this year with the 3.8 percent tax still scheduled to take effect next year, said Elda Di Re, partner and area leader of the personal-financial services tax division at Ernst & Young in New York.

Stock Options

High earners also may accelerate income from stock options or bonuses into this year to avoid the additional 0.9 percent tax on their wages exceeding the thresholds scheduled for 2013, Steffen said.

Sue Stevens, chief executive officer of Stevens Wealth Management based in Deerfield, Illinois, said she may seek ways to keep clients below the $200,000 or $250,000 thresholds by staggering the taxable income they receive over several years if possible.

Wealthy investors also may buy municipal bonds because income from them is exempt from the 3.8 percent levy on unearned income, said Tim Speiss, chairman of the personal wealth advisers practice at EisnerAmper LLP, an accounting and advisory firm in New York.

Greater Consequences

The effect of the levies in the health-care law will have even greater consequences for wealthy taxpayers if tax cuts first enacted during the presidency of George W. Bush expire as scheduled at the end of 2012. Unless Congress acts, the top rate on long-term capital gains and dividends, now 15 percent, would go to 20 percent and 39.6 percent, respectively. For high earners who exceed the threshold, that means the health-care tax would bring the levy on dividends to as much as 43.4 percent.

Investors shouldn't overreact to the Supreme Court decision as several months remain before the end of the year to make investment decisions and consider market performance, said Steffen. The results of the presidential election in November also may change tax policy, he said.

|

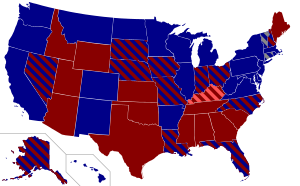

| English: Depiction of the House vote on H.R. 3590 (the Patient Protection and Affordable Care Act) on March 21, 2010, by congressional district. Democratic yea Democratic nay Republican nay No representative seated (Photo credit: Wikipedia) |

Industry Fees

|

| English: Depiction of the Senate vote on H.R. 3590 (the Patient Protection and Affordable Care Act) on December 24, 2009, by state. Two Democratic yeas One Democratic yea, one Republican nay One Republican nay, one Republican not voting Two Republican nays (Photo credit: Wikipedia) |

One of the most controversial elements of the law among Democrats was a 40 percent excise tax on what some lawmakers called "Cadillac," or high-cost, health-care plans. While that tax isn't scheduled to take effect until 2018, many employers with generous benefits have already made adjustments to avoid the levy.

High Deductibles

Those moves include offering high-deductible insurance with savings accounts, adopting wellness incentives for employees and increasing the amount that workers pay for medical expenses, said Steven Wojcik, vice president of public policy for the Washington-based National Business Group on Health, which represents mostly large employers.

The Supreme Court decision has "cleared up some of the cloud of uncertainty hanging over the law and employers should go forward preparing for the upcoming provisions that are going to affect employer plans," Wojcik said. …

The law also included a 10 percent excise tax on indoor tanning, stopped paper companies from getting certain tax breaks for making a byproduct called "black liquor" and codified a judicial doctrine against tax shelters.

No comments:

Post a Comment