It can be complicated—the trick is helping participants create plans that work.

PLANSPONSOR.comJuly 2012

Rebecca Moore

Illustration by Josh Cochran

The amount of income workers will need in retirement and how much they should save to reach that goal have gained more attention since the economic downturn of 2008 and 2009 depleted many retirement accounts. Before the downturn, service providers and researchers in the industry estimated that workers would need to replace between 70% and 75% of their preretirement income— i.e., what came from all sources. But even then, that estimate was being scrutinized.

Target income replacement ratios should be higher, the Retirement Advisor Council now contends. In a paper, the council says this is to account for the always increasing projected cost of health care in retirement, as well as other financial planning concerns workers face, such as children’s educational needs and the cost of caring for elderly relatives.

|

| saving and spending (Photo credit: 401(K) 2012) |

When trying to arrive at the best income replacement rate for themselves, workers should use their imaginations, says Jason Scott, Ph.D., director of the Financial Engines Retirement Research Center. They should imagine continuing to do things postretirement that they did preretirement. Then they should consider expenses they will no longer have once they retire. … Some retirees can make it with a lower income in retirement, Scott believes, but, he notes, if individuals will travel or spend more in their free time, expenses they incur will offset the savings, meaning they may need more income.

|

| Pension (Photo credit: Frederik Seidelin) |

Patricia Advaney, senior vice president of participant solutions at Diversified, says that because the standard

estimate replacement ratio of 70% to 75% may be inadequate, workers should think about increasing their goal. “It’s a moving target, with questions about Social Security, the rising cost of health care and longevity,” she says. The industry has shifted from trying to give an exact number for target replacement income to suggesting a minimum 10% savings for retirement, including both employee savings and employer match.

|

| English: Proportion of pay to save. (Photo credit: Wikipedia) |

The Retirement Advisor Council says, regardless of target income, a consistent contribution to 401(k) and 403(b) plans in the range of 10% to 16% of pay over a 30-year or 40-year career is needed to achieve the appropriate replacement retirement income.

In a research paper, “What’s the Right Savings Rate?”, Russell Investments contends that the total replacement income (TRI) 30 rule-of-thumb helps answer the question: “How much should participants save?” Saving 30% of the TRI rate each year—including personal savings, savings in an employer-sponsored retirement plan and any employer contribution—leads to about a 90% probability of meeting the income goal at retirement. This assumes a 40-year period of savings, Cohen notes.

|

| English: Retirement savings rate as squirrel and nuts anaology (Photo credit: Wikipedia) |

According to the Employee Benefit Research Institute’s (EBRI’s) Retirement Security Projection Model (RSPM), 44% of Baby Boomers and Generation Xers are still projected to be “at risk” of running short of money in retirement. …

The trick is helping people figure out, wherever they are, how to create a plan that works, according to Scott. …

Workers should think about how they might boost savings by working longer, and therefore saving more, or being savvier about other benefits, such as claiming Social Security at a later age, Scott says.

A brief from the Center for Retirement Research (CRR) at Boston College concludes that starting early to save for retirement and working longer are more effective levers for ensuring retirement security than earning a higher return on savings. “How Much to Save for a Secure Retirement” said this strategy of saving longer is especially effective, given the greater risk that comes from chasing investment returns.

|

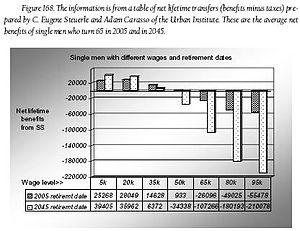

| English: In the United States, Social Security benefits compared for younger vs. older workers. According to author Joseph Fried, this graphic uses information from: C. Eugene Steuerle and Adam Carasso, "The USA Today Lifetime Social Security and Medicare Benefits Calculator," (Urban Institute, October 1, 2004), from: http://www.urban.org/publications/900746.html. Note: The calculator does not include the value or cost of the Social Security disability program. (Photo credit: Wikipedia) |

70 than age 62. As a result, they replace a much larger share of preretirement earnings if workers wait to apply—29% if they are 62 and 52% if 70, in the CRR’s example—reducing the amount they would need to take from savings. And, by postponing retirement, people have additional years to contribute to their 401(k) and allow their balances to grow. Finally, a later retirement age means that people will have fewer years of dependence on their accumulated retirement assets.

Plan sponsors can help with reporting, to show how far behind workers are, Cohen says. Then decisions can be made, …

“You can’t invest your way out of a savings problem. There may be different asset allocations that would be better, but, at the end of the day, investments can only do so much,” Cohen says. “It’s all about savings patterns, how long you work and reasonable expectations.”

According to Cohen, plan sponsors can set goals for participants and use the match formula as an incentive. For example, if a participant needs 15% put away each year and the company is willing to contribute 5%, the match formula would be 50 cents on the dollar, up to 10% of compensation. At the same time, plan sponsors can help participants get to that 10% by using automatic enrollment and automatic escalation.

“It takes a well-designed plan and the smart use of … auto-features and qualified default investment alternatives [QDIAs] [which], if implemented, [can give] the typical American worker … a very successful retirement,” Scott concludes.

Kristi Mitchem, head of global defined contribution at State Street Global Advisors, says workers today are in a much better position than before because the introduction of auto-enrollment has been incredibly powerful in getting participants of different income levels into retirement plans early and saving at an appropriate level. “We have put mechanisms into place to help people get on the right path and be successful,” she says.

Mitchem recommends plan sponsors auto-enroll at a 4% to 6% employee deferral range. They can pair that with auto-escalation up to 10%. And, as always, plan sponsors should communicate the importance of deferring substantial savings for retirement, according to Mitchem.

Advaney suggests retirement plan sponsors use service provider resources to help participants save more. …

“This is an incredibly important topic because the reality is, the biggest contributor of what you have in retirement is how much you put away,” Mitchem says. “So, getting people comfortable at an appropriate savings rate is the most important thing to ensure [they] have appropriate retirement savings.”

Everyone needs guidance on saving for retirement, but this is especially true for middle-income workers, says Kristi Mitchem, head of global defined contribution at State Street Global Advisors. While high-income workers will have less income replaced by Social Security, they presumably will have more personal savings to supplement their retirement income, and lower-income workers will have a higher percentage of income replaced by Social Security.

|

| English: This is a chart outlining the historical personal savings rates in United States as compiled by the US Department of Commerce, Bureau of Economic Analysis (Photo credit: Wikipedia) |

More than any other group, middle-income workers should take advantage of all resources available, says Patricia Advaney, senior vice president of participant solutions at Diversified. … Middle-income workers need to start thinking about what they will need and should hold onto retirement paperwork until positive they can retire. Retirement plan advisers need to have conversations early enough for middle-income workers to understand the implications of any decisions they will have to make.

No comments:

Post a Comment