By CONSTANTINE VON HOFFMAN

Play VIDEO What is the "fiscal cliff?"

Play VIDEO What is the "fiscal cliff?"(MoneyWatch) Taxes for nearly 9 of 10 Americans will rise by an average of $3,500 a year if Congress and the White House fail to reach a deal that avoids the so-called fiscal cliff.

| Income Tax Cocktail (Photo credit: Kenn Wilson) |

Most of the increase would come from the scheduled expiration of tax cuts enacted in 2001 and 2003 during the George W. Bush administration. The expiration of President Obama's payroll tax holiday, which shaves 2 percentage points off payments to Social Security, would also contribute to the rise.

… "It's just a huge, huge number," said Eric Toder, an Urban Institute scholar, in a conference call to discuss the report.

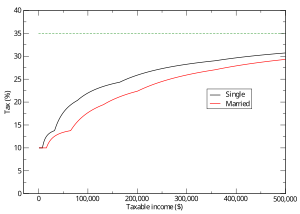

The top 20 percent of income-earners -- those with mean annual earnings of more than $170,000 -- would experience the highest tax increase, at 5.8 percent (see chart at bottom). That would push the average federal income tax rate for taxpayers in this bracket to 30.9 percent. As a result, they would end up paying 60 percent, or $300 billion, of the additional revenue from the rise in rates.

A middle-class household, with income between $40,000 and $64,000, would see its taxes rise by about $2,000. The bottom 20 percent of earners -- those with mean income of less than $15,900 -- would pay the least in total dollars, at $16.1 billion.

| Earned Income Tax Credit (EITC)35 (Photo credit: Antonio Villaraigosa) |

| US taxes as a percent of income in 2008. (Photo credit: Wikipedia) |

Although most lawmakers say they favor extending the income tax cuts, there is bitter partisan dispute over for whom. Republicans generally want to preserve all the income and estate tax cuts for 2013, including for top income-earners, arguing that the resulting decline in government revenue can be plugged by eliminating tax loopholes. Democrats, including President Obama, want to let most of of the tax cuts lapse for the top 2 percent of households, or individuals making more than $200,000 a year and married couples making more than $250,000.

| English: Plot of top bracket from U.S. Federal Marginal Income Tax Rates for 1913 to 2009. Data are from http://en.wikipedia.org/wiki/Income_tax_in_the_United_States#History_of_progressivity_in_federal_income_tax (Photo credit: Wikipedia) |

Another potential side effect of the fiscal cliff: Growing skepticism that Congress will reach an agreement on taxes and spending could lead to a large sell-off of stocks and other financial assets later this year as people try to avoid the higher capital gains rate.

"If investors really believe that the tax rate they face on capital gains is about to go up significantly, some of them will choose to realize accumulated gains this year rather than next year," said Donald Marron, one of the authors of the study.

BROOKINGS-URBAN INSTITUTE TAX POLICY CENTER

© 2012 CBS Interactive Inc.. All Rights Reserved.

No comments:

Post a Comment