Tech | May 22, 2013 | CFO.com:

Marielle Segarra

Electronic payments are becoming more popular among small and midsize businesses. In a recent report by consulting firm Greenwich Associates, 43% of small companies and 55% of large middle market companies said they expect to increase the number of e-payments they make over the next 12 months.

|

| A Fraud Scheme provided by FBI (Photo credit: Wikipedia) |

Small and midsize companies may not realize that banks are not required to protect them from payment fraud, says Peter Bible, chief risk officer at accounting firm EisnerAmper. UnderRegulation E, a regulation established by the Federal Reserve, banks are only responsible to protect “natural persons” (human beings), not corporate customers, from fraud.

“The law is written for people like you and me,” Bible says. “Until two or three years ago, when things were still done with checks and security was not really an issue for wire transfers, most companies had very good controls in place to keep theft from occurring. But the hackers have really taken this to a new level.” ...

|

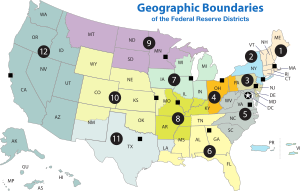

| English: A map of the 12 districts of the United States Federal Reserve system. (Photo credit: Wikipedia) |

Payment fraud is a “huge concern,” particularly for smaller companies, says BC Krishna, president and CEO of MineralTree, an online payment tool provider. “It’s a very complicated problem, because fraudsters are generally ahead of the game,” Krishna adds. “There’s a gap between the current state of the defenses and the nature of the fraud itself.”

Though payment fraud is difficult to quantify, “many people say it runs close to $1 billion a year and that it’s growing,” Krishna says. “It tends to affect small and medium-size businesses, because they’re the ones that have the weak controls, as opposed to the larger corporations.”

Bible agrees. “For larger entities, they’re going to catch it if someone has hacked their bank account,” he says. “Most major companies have very good controls and they look at their cash activity daily if not hourly. But you just don’t have that luxury in a small organization.”

The Greenwich Associates survey also found that while companies are eager to embrace electronic payments, many are reluctant to recommend their current banks for e-payment services. The survey defined small businesses as those with revenues between $1 million and $10 million and large middle-market companies as those with revenue between $100 million and $500 million.

No comments:

Post a Comment