|

| Retirement (Photo credit: 401(K) 2013) |

Reuters:

CHICAGO |

A growing number of 401(k) plans are including investment choices that can help savers convert nest eggs into retirement income. Participants can buy insurance annuities or other products designed to spread funds over a lifetime.

These programs aim to make 401(k)s more like traditional pensions. That's laudable if it helps retirees cope with "longevity risk" - that is, the risk of exhausting savings in a retirement of unpredictable length.

But the new retirement income initiatives have disadvantages too, so savers should proceed carefully. Here are some points to consider if one of them shows up in a 401(k) plan near you.

THE ANNUITIES PUSH

|

| English: Types of Annuities (Photo credit: Wikipedia) |

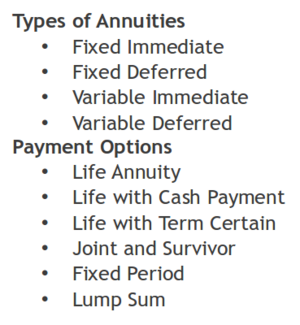

The industry is pushing two annuity types for the workplace market - fixed and variable. A fixed annuity allows you to purchase a specified amount of guaranteed income for life, with the payments determined by the amount you invest, prevailing interest rates at the time of purchase (higher is better) and when you want to start receiving the income. The payout on a variable annuity can vary, depending on the earnings of the investments within the annuity.

Either option can be immediate, meaning you don't buy it until you're ready to collect the income stream, or deferred, meaning that you buy it years in advance and let it grow before you tap it.

A popular type of variable annuity for retirement plans is the guaranteed minimum withdrawal benefit annuity, or GMWB, ... Here, you invest in a portfolio of stocks and bonds for 10 years prior to retirement; the initial withdrawal amount is linked to the amount in the account. Payments can rise in subsequent years if the portfolio investments beat certain pre-agreed benchmarks.

The advantage over other annuities is the guarantee: if you die before the assets have been used up, your heirs get what's left. Other annuities, in contrast, require you to surrender control of the invested funds when you start taking payouts, though they tend to offer higher payoffs.

A $100,000 investment in a GMWB might yield annual retirement income of $5,000 for someone retiring at 65, according to calculations from Josh Cohen, defined contribution practice leader at Russell Investments. If the portfolio performs really well, the annual income amount could rise to $5,750 at age 85, but the odds of that aren't good, Cohen says.

The same investment in a fixed deferred annuity would get the retiree $6,360 in annual income. Or, he could take a bit less initial income ($4,836) but get a 2.5 percent annual inflation adjustment that would spin off $7,900 annually at age 85.

Some companies are offering another option: A pre-set portfolio designed to generate income for the long haul. ...

GUARANTEED DRAWBACKS

GMWBs "can be mind-numbingly complex to understand, and it's difficult to figure out what they really cost," says David Blanchett, head of retirement research at Morningstar. They can be pricey, but those tucked inside 401(k)s benefit from lower institutional pricing. ...

Blanchett worries that putting annuities in 401(k)s could prompt some workers to purchase them prematurely. Because of the annual insurance costs, it only makes sense for older workers within a decade or so of retirement to jump in.

Even insurance sellers caution retirees not to annuitize all of their savings, so there are liquid assets left for large and unexpected expenses.

(The writer is a Reuters columnist. The opinions expressed are his own.)

(Follow us @ReutersMoney or here. Editing by Linda Stern)

'via Blog this'

No comments:

Post a Comment